Introducing Forex Trading to Pakistan

So, you’re probably wondering, what’s all this Forex Trading / Forex Markets stuff about?

And more importantly – How you can make some money from it!

The Forex Market is a market in which you can buy, sell, and exchange currencies. The global forex market primarily comprises of banks, investment funds, central banks, commercial companies, and of course speculative forex traders.

There are large transactions occurring all the time e.g. Toyota Company in Japan exports and sells its Corolla cars in Pakistan, and buys and imports American made car parts. In this example, Toyota is selling Corollas for a total of billions of PKR, then converting this into Japanese Yen (JPY) and bringing the money back to Japan. Then to import its car parts from USA, it is converting its JPY to USD to make payments to the US-Based Parts Manufacturer. Similarly, there are transactions, investments, and speculative bets in the billions happening daily in the Forex Market.

The Forex Market is the LARGEST financial market in the world! To put this in perspective, the Pakistan Stock Exchange (PSX) has an Average Daily Trading Volume of $50 million. The largest stock exchange in the world – the New York Stock Exchange (NYSE) has an Average Daily Trading Volume of $22.4 billion. Finally, the Forex Market has an Average Daily Trading Volume of $5 Trillion! That’s $5000 billion changing hands daily! That’s equal to almost 1/4th the USA GDP or 16x times the GDP of Pakistan!

As you can imagine, the larger the market, the greater the opportunities. The Forex Market is not as volatile (meaning price fluctuates much less) as the Cryptocurrency Market or even the Stock Market. However, this provides traders and investors and opportunity to profit by using calculated risk / reward ratios, and technical analysis because of the set trends and patterns that have already been established in the market over decades, and by using large amounts of leverage that brokers provide.

Forex Market Timings and Hours

The other huge advantage that the Forex Market presents is that it is open 24 hours a day from Monday to Friday, unlike the stock market which is open from 9AM to 5PM from Monday to Friday. Of course, there are timings during the day during which the Forex Market has more liquidity and thus volatility (meaning a bigger range of price change) during certain hours.

These timings of volatility and liquidity coincide with the three major time sessions in the world: The European Trading Session which is when the UK Markets awaken from 7AM to 4PM GMT (12PM to 9PM Pakistan time), the American Trading Session which is when New York Markets awaken from 12PM-8PM GMT (5PM to 1AM Pakistan time), and the Asian Trading Session which is when Tokyo Markets awaken from 1AM-6AM GMT (6AM-11AM Pakistan time). The most volatility is usually had during times that overlap with two time sessions.

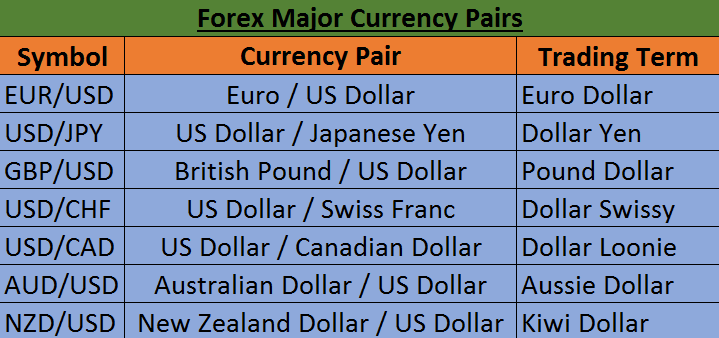

Forex Currency Pairs

Before you begin trading Forex Markets, you should know that there are 7 major Forex Pairs traded which comprise 85% of the total volume in the forex market. A Forex Pair means two currencies that are traded against each other. This is important to understand as, when trading forex, you will always be betting on one currency rising or falling against the other. E.g. if you are trading EUR/USD (which means you are looking at the Euro vs the US Dollar), you might see on a Trading Platform that 1 Euro is equal to 1.12055 US Dollars. You can now bet whether the Euro will rise (which means it will be equal to MORE THAN 1.12055 USD) which is known as being “long” the Euro. Or you may bet that the EUR falls (which means it will be less than 1.12055 USD e.g. like 1 EUR will eventually equal 1.12005 USD) which is known as “shorting” the EUR / being “short” the EUR.

The Major Forex pairs traded are:

EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD and USD/CAD

Overview of Trading Forex Currency Pairs

When trading Forex, you will always be betting on one currency rising or falling against the other. E.g. if you are trading EUR/USD (which means you are looking at the Euro vs the US Dollar), you might see on a Trading Platform that 1 Euro is equal to 1.1205 US Dollars. You can now bet whether the Euro will rise (which means it will be equal to MORE THAN 1.1205 USD) which is known as being “long” the Euro. Or you may bet that the EUR falls (which means it will be less than 1.1205 USD e.g. like 1 EUR will eventually equal 1.1105 USD) which is known as “shorting” the EUR / being “short” the EUR.

This small change in the example above would be called a 100 pip change in the value of EUR/USD.

What is a Pip you ask? It stands for “point in percentage” and it is 1/100th of 1%. In most currency pairs (except the Japanese Yen pairs), it is the 4th number after the decimal i.e in $0.0001, 1 represents the pip.

The next question is, how can you make money from such a small fluctuation in price? Especially, if you have only a small amount of money to invest like $1000? That’s where leverage comes in. Read on below to see what “lots” and “leverage” are:

Lots & Leverage

Let’s start with what a “Lot” is in Forex terms. A standard lot is 100,000 units worth of a currency. Meaning, if I’m trading EUR/USD and I think the EUR will increase / rise in price, so I go long 1 lot, that means I have purchased 100,000 Euros against the USD.

Pip value in a standard lot can be a little tricky. It also depends on the account currency you keep with your broker (which we recommend you should always have a base currency of USD in your account especially if you’re from Pakistan or the UAE). Let’s assume you have an account base currency of US Dollars. Whether you’re trading EUR/USD, EUR/GBP, AUS/CAD, if you gain one pip trading a standard lot, it will equal to 10 units of the second currency in the trading pair (meaning in this example, USD, GBP, or CAD). These 10 units of profit will be converted into your account base currency and reflect your new balance.

Now time for the most important question on your mind! “But how will I actually make money if I have to have $100,000 worth in my account?! By using leverage!

Almost all brokers provide you leverage when you trade Forex Markets. Meaning, if a broker provides you 1:100 leverage, you can deposit $1000 into your account and trade with $1000×100 = $100,000! That’s how you can make huge profits on small fluctuations in the Forex Market!

We recommend some trusted brokers for this, who provide large amounts of leverage, are trustworthy and certified, and especially welcoming to Pakistani and UAE based clients.

3 Steps to Get Started with Forex Trading

Here are some simplified steps to get you started with Forex Trading. The first step is, you will need to sign up / open an account with a broker.

1. Sign up with a Broker: (More details in the “Choosing a Broker” Section)

(If you want to become a fully funded trader without using your own money, skip this step and view: “I Don’t Have Enough Money To Start Trading“)

A broker will provide you with an online platform to trade foreign currencies, along with many other tools such as leverage, and even training tools. We recommend you sign up with a broker first, as you may even use a practice account with virtual “fake” money to practice trading before jumping in to the real deal. You do not immediately need to fund your account, though we suggest you do so with a small amount to start off so you can gain access to the full functional features of their platform and start getting used to it.

However, you must be careful in selecting the right broker, as there are many fraudulent or unreliable ones out there – especially with the limited choice available to people from countries such as Pakistan, UAE, India, Sri Lanka, and so on. But don’t worry, we have verified and certified brokers we will suggest to you in the next section.

2. Gain deeper knowledge of Technical Analysis in Forex:

You need to get set up with a broker first so that you can get set up on their trading platform which will allow you to get the feel for trading and studying forex price charts. The recommended trading platform that most brokers have is Metatrader 4 and Metatrader 5.

There are many ways to trade the Forex Market. The same way people buy and sell stocks based on news, one can trade the Forex Market with this strategy. This is called trading based on “fundamentals” (such as news like interest rate changes, GDP data, unemployment data etc from countries whose forex pairs you’re trading against each other).

We recommend trading based on “technical analysis” however as it gives you a statistical advantage by betting on tried and tested trading patterns in the forex market.

An excellent FREE online course for learning in-depth Forex Trading is provided at the Baby Pips Forex School.

You will learn more about technical analysis once you go to our “How to Trade Forex Markets” Section.

3. Begin trading:

Sounds simple, but you should begin your journey into being a trader using real money as soon as you can. There’s no substitute for real practice and experience. We highly recommend you continue learning as you trade, since becoming a trader is a never-ending learning process even while you make money.

Remember, every trader in the world WILL have losses. The key is practicing good risk management and emotional control. Make sure your wins are bigger than your losses. Always cut losses at a pre-determined level. Therefore, only take any trade when you have a plan.

Choosing a Broker

Almost all brokers provide you leverage when you trade Forex Markets. Meaning, if a broker provides you 1:100 leverage, you can deposit $1000 into your account and trade with $1000×100 = $100,000! That’s how you can make huge profits on small fluctuations in the Forex Market!

It is important you pick a good broker. In the world of forex and trading there are a lot of unreliable brokers who hide their commission structure, and even trade against you.

We recommend some trusted brokers who provide large amounts of leverage, are trustworthy, certified, regulated, and especially welcoming to Pakistani and UAE based clients. These brokers are:

1. XM

XM is a broker founded in 2008 and has over 2.5 million clients from 196 countries. Furthermore, XM has licenses from regulatory bodies: FCA (U.K), IFSC (Belize), CySec (Cyprus), and ASIC (Australia).

XM offers up to 1:888 leverage to trade Forex, Cryptos, and even USA Stocks like Google, Microsoft, etc.

This means, if you deposit $1000 with XM, you can trade position sizes equal to $888,000. Pretty cool, huh?

Another great thing about XM is that they are supportive of Pakistani clients and even have customer support reps who can communicate in Urdu / Hindi. They offer several types of accounts for different levels of traders depending on the amount you have available to trade with. You can view the account types here: https://www.pakcryptoinvestor.com/XM-Account-Types

They even offer Islamic Accounts for those interested in trading according to Islamic Principles: https://www.pakcryptoinvestor.com/XM-Islamic-Trading

Currently, if you open a XM account, they are offering you 15% extra on whatever amount you deposit, up to a total of $500. Meaning, if you deposit $3500, you will get $4000 in your XM account.

The best part about XM for a client from Pakistan is, that they are very facilitating in your deposits and withdrawals. If you wire over $200 to XM, they will cover the incoming wire charge, and if you use a credit card to fund your account, they won’t add any charges, and the funds will be available to trade with immediately in your account!

We recommend XM highly as a broker. They are transparent, regulated, have low commissions, offer Muslim / Islamic trading forex accounts, accept many easy forms of payment, offer large amounts of leverage, and have a vast number of financial instruments from stocks to forex to cryptos that you can trade.

It takes 15 minutes to register. Sign up using this link to avail 15% extra on your deposit: https://www.pakcryptoinvestor.com/XM-Register-Account

2. FXTM

FXTM stands for forextime.com. It was founded in 2011, and is registered in Cyprus. FXTM is a well respected broker that offers over 50 currency pairs to trade, including various other financial instruments such as commodities, and CFDs.

FXTM offers MT4 and 5 much list XM does. They also offer easy account funding options such as paypal, skrill, credit cards, debit cards, and wire transfers.

The leverage offered by FXTM is a maximum of 1:1000. However, the account type options are relatively limited as compared to XM.

FXTM also offers copy-trading which personally, we at Pak Crypto Investor do not recommend anyone to copy others trading as they might be trading completely different sizes with different risk/reward and stop loss ratios to yours.

FXTM vs XM for Pakistani Clients

Both FXTM & XM offer great bonuses, large selection of financial instruments to trade, and various options to fund accounts. Altogether, both are great brokers to get started with, and have comprehensive learning libraries and offer paper trading.

However, we will say that FXTM is especially supportive of Pakistani Clients, and accepts many deposit options from bitcoin, to credit cards, to even accepting local deposits into a Pakistani Bank Account through certain trust partners such as Pak Crypto Investor.

Please contact us if you would like to avail the local bank deposit option for FXTM.

What if I Don't Have Enough Money to Start Trading

Now, we realize there are very talented individuals who have the skills, discipline, dedication, and knowledge to trade Forex Markets, but don’t have the capital. Maybe you’ve learned to trade Forex, and used a demo account to discover you could potentially make thousands of dollars if only you had some money to start with.

If that sounds like you, you’re in luck, as we’re going to tell you how to become a Fully Funded Trader without using your own money to trade!

For the first time ever, Pak Crypto Investor brings you Prop Trading:

Prop Trading is when you trade using somebody else’s money with no risk of personal loss. The profits you make are split between you and the prop firm that is funding you.

Pak Crypto Investor is partnered with Fidelcrest who are providing talented potential traders an opportunity to prove themselves by making 5-10% gains on a demo account within 10 to 30 days, and then receive ACTUAL FUNDING to trade with.

They charge a small one-time fee ranging from $50 to $420 depending on the account size you’re applying for. For $50, you can trade a $2500 account (with leverage), and for $420 you receive a $50,000 account to complete their challenge. If you make the set profit target (between 5-10%) on the account within 10-30 trading days, you will receive the fully funded account. Once you start trading the fully funded account, you will get to keep a majority of your profits (up to 80%) while a percentage will go to Fidelcrest for providing you with their funds.

This is an amazing opportunity you can access with a very small amount of investment. We’re proud to present this to our followers in Pakistan considering the immense amount of potential there is.

Do you believe you have what it takes to become a fully funded trader by completing the Fidelcrest Challenge? Find out by clicking the button below: